Quick answer: When travelling in Vietnam, the Vietnamese đồng (VND) is the official currency. Cash is king, especially for small purchases and in rural areas, but credit cards are increasingly accepted in cities and tourist spots. ATMs are widely available, and it’s best to carry some cash for convenience and to avoid fees.

At a glance:

- 💵 Currency: Vietnamese đồng (VND)

- 🏧 ATMs: Widely available in cities and towns

- 💳 Credit/Debit cards: Accepted in many urban shops, hotels, restaurants

- 💰 Cash usage: Essential for markets, street food, small vendors, and rural areas

- 📌 Currency exchange: Best rates found in banks or authorized exchange counters

For smooth travel, always have some cash on hand, especially in less touristy places.

Last updated in November 2025

What is the official currency of Vietnam?

Vietnamese Dong (₫, VND) serves as Vietnam’s official currency, with exchange rates hovering around 1.00 USD = 25,000 VND (March 2024). Interestingly, US Dollars are widely accepted alongside the dong, particularly in tourist areas. Since 1978, the dong has been Vietnam’s primary currency, maintaining relative stability. Its value typically remains around 23,000 VND to 1 USD, making it convenient for locals and tourists alike.

For currency exchange, it’s advisable to use official counters or banks to ensure fair rates and authenticity. While US Dollars are convenient for larger transactions, having dong on hand is essential for smaller purchases. Airport exchanges cover immediate needs, but banks, exchange offices, and ATMs throughout cities provide ample opportunities to obtain dong. Credit and debit cards are also widely accepted, especially in larger establishments.

Understanding dong denominations is crucial for smooth transactions. Banknotes range from 100₫ to 500,000₫, with coins available in smaller values. Familiarizing yourself with these denominations helps avoid confusion during purchases.

💸 Types of paper money in Vietnam (coins are not used):

200, 500, 1000, 2000, 5000, 10 000, 20 000, 50 000, 100 000, 200 000, 500 000.

Another option is to pay with US Dollars (this option is illegal officially). US Dollars are not also accepted at some retail outlets, small cities or villages. You can use them only in the big cities.

🏦 What are the banks in Vietnam?

Central bank of Vietnam is State bank of Vietnam. Almost every big city has several banks, and with exchange you should not have a problem. The most known banks in Vietnam are VietinBank, Vietcombank, Sacombank, Agribank, Eximbank. Opening hours are usually from 8 to 16 hours (there is a lunch break of about 1.5 hours), Saturday from 8 to 11:30.

| Banks in Vietnam | Website |

|---|---|

| Vietcombank | vietcombank.com.vn |

| BIDV | bidv.com.vn |

| Techcombank | techcombank.com.vn |

| VietinBank | vietinbank.vn |

| ACB | acb.com.vn |

| Sacombank | sacombank.com.vn |

| VPBank | vpbank.com.vn |

| TPBank | tpb.vn |

| MB | mbbank.com.vn |

| Agribank | agribank.com.vn |

Which foreign banks in Vietnam you can use and visit?

There are several foreign banks that operate in Vietnam and offer a range of banking services to customers. Some of the most well-known foreign banks in Vietnam include:

1. HSBC: HSBC has been operating in Vietnam since 1870 and is one of the largest foreign banks in the country. They offer a range of banking services to both individuals and businesses, including savings accounts, credit cards, and corporate banking solutions.

2. Standard Chartered: Standard Chartered has been operating in Vietnam since 1904 and is another well-established foreign bank in the country. They offer a range of banking products and services, including personal loans, credit cards, and trade finance solutions.

3. Citibank: Citibank has been operating in Vietnam since 1993 and offers a range of personal and business banking solutions to customers. They have branches in Hanoi and Ho Chi Minh City, as well as a number of ATMs located throughout the country.

4. ANZ Bank: ANZ Bank has been operating in Vietnam since 1993 and is one of the largest foreign banks in the country. They offer a range of banking products and services, including personal and business banking, as well as investment and wealth management solutions.

These banks typically have branches located in major cities such as Hanoi and Ho Chi Minh City, as well as a network of ATMs located throughout the country. Customers can visit these branches to open accounts, apply for loans, and access a range of other banking services.

🏧 Cash dispensers, ATM and credit cards in Vietnam:

Vietnam has made great strides in modernizing its banking system in recent years, with the proliferation of cash dispensers, ATMs, and credit cards in major cities and tourist areas.

One of the most noticeable changes has been the increase in the number of cash dispensers, or „ATMs“ as they are commonly called. These machines are now widely available in most urban areas, and they offer a convenient way for locals and tourists alike to withdraw cash at any time of day or night. The machines typically accept major credit and debit cards, and some also offer the option to withdraw cash in US dollars.

Alongside cash dispensers, ATMs have also become increasingly popular in Vietnam. These machines offer many of the same features as cash dispensers but also allow customers to check their account balances, transfer funds between accounts, and pay bills. In many cases, they also offer English language interfaces, making them more accessible to foreign visitors.

Finally, credit cards have also become more common in Vietnam in recent years. Most major hotels, restaurants, and shops now accept credit cards, and there are also a growing number of local banks that offer credit cards to Vietnamese citizens. For tourists, credit cards can be a convenient way to pay for large purchases or to withdraw cash in emergencies.

Overall, the proliferation of cash dispensers, ATMs, and credit cards has made it easier than ever for visitors to access their money in Vietnam. With these modern conveniences, travelers can focus on enjoying the country’s vibrant culture, stunning landscapes, and delicious cuisine.

💳 Which credit cards you can use in Vietnam?

In Vietnam, you can use major credit cards such as Visa, Mastercard, American Express, and JCB (Japan Credit Bureau) at most hotels, restaurants, and shops that accept card payments. However, it’s always a good idea to check with the merchant or service provider before using your credit card, as some smaller businesses may only accept cash payments.

In addition, some local banks in Vietnam issue credit cards that are primarily designed for Vietnamese citizens. These cards may offer local benefits and rewards, but they may not be as widely accepted by international merchants. If you plan on using a local credit card, it’s best to check with the bank beforehand to confirm where the card is accepted.

Overall, it’s recommended to bring multiple payment options when traveling to Vietnam, including cash and credit cards from major international issuers. This will ensure that you have a variety of payment options available to you, regardless of where you go or what you need to buy.

Is it possible to use ATM in the airports in Vietnam?

Yes, it is possible to use ATMs at the airports in Vietnam. Most major airports in the country have ATMs located within the terminal buildings, including Tan Son Nhat International Airport in Ho Chi Minh City, Noi Bai International Airport in Hanoi, and Da Nang International Airport in central Vietnam.

These ATMs typically accept major international credit and debit cards, such as Visa, Mastercard, and American Express, as well as local bank cards issued by Vietnamese banks. Some ATMs may also allow you to withdraw cash in US dollars, although this will depend on the specific machine and the bank that operates it.

It’s worth noting that airport ATMs can sometimes be busy or have long queues, particularly during peak travel periods. To avoid any issues, it’s a good idea to withdraw cash in advance or to have alternative payment options available, such as a credit card or traveler’s checks.

Is it possible to exchange your money in the airport in Vietnam?

Yes, it is possible to exchange your money at the airports in Vietnam. Most major airports in the country have currency exchange booths located within the terminal buildings, where you can exchange foreign currency for Vietnamese dong or vice versa.

These exchange booths are typically open 24 hours a day, and they offer competitive exchange rates. However, it’s worth noting that exchange rates may vary between different booths, so it’s a good idea to compare rates before making a transaction.

In addition to currency exchange booths, some airports in Vietnam also have ATMs that allow you to withdraw Vietnamese dong using your international debit or credit card. This can be a convenient option if you don’t have any local currency on hand, but be aware that ATM fees may apply, and exchange rates may be less favorable than those offered by currency exchange booths.

Overall, it’s recommended to exchange at least some currency before arriving at the airport in Vietnam, as rates may be more favorable at banks or exchange offices located in town. However, if you do need to exchange money at the airport, there are usually several options available to you.

What are the ATM fees and withdrawal limits?

-

- Vietcombank – ATM Fee – 50.000 VND | Withdrawal limit 2.000.000 VND

- ANZ – ATM Fee – 40.000 VND | Withdrawal limit 5.000.000 VND – 10.000.000 VND

- Citibank – ATM Fee – 55.000 VND | Withdrawal limit 5.000.000 VND – 10.000.000 VND

- Agribank – ATM Fee – 22.000 VND | Withdrawal limit 3.000.000 VND

- BIDV – ATM Fee – 30.000 VND | Withdrawal limit 2.000.000 VND

- Sacombank – ATM Fee – 30.000 VND | Withdrawal limit

(these information can change)

– in the remote provinces may be a problem with the selection (blocking foreign cards – take your cash)

– 1 withdrawal fee is about 1-3% of the amount withdrawn- all withdrawals are in Vietnamese dongs

– larger cash advance can be arranged during office hours with bank staffs

– foreign currency can be exchanged in the bank

Before departing to Vietnam, announce your intention of traveling to your bank!

Your bank may block your credit card!

⚠️ What to watch out in Vietnam when exchanging your money:

When exchanging your money in Vietnam, there are a few things that you should watch out for to ensure that you get a fair exchange rate and avoid any scams or fraudulent practices. Here are some tips to keep in mind:

1. Compare exchange rates: Exchange rates can vary widely between different exchange booths, so it’s a good idea to compare rates before making a transaction. Look for exchange booths that offer competitive rates and avoid those that seem too good to be true.

2. Check for hidden fees: Some exchange booths may charge hidden fees, such as service charges or commissions, which can significantly reduce the amount of money you receive. Make sure to ask about any fees before making a transaction.

3. Count your money carefully: Before leaving the exchange booth, count your money carefully to ensure that you have received the correct amount. Some unscrupulous exchange booths may try to shortchange you by giving you less money than you are entitled to.

4. Avoid street vendors: While it may be tempting to exchange money with street vendors who offer attractive rates, it’s best to avoid these individuals as they may be engaging in fraudulent practices. Stick to reputable exchange booths located in banks, hotels, or major shopping centers.

5. Use reputable banks: If you need to exchange a large amount of money, it’s best to use reputable banks that are well-established and have a good reputation. This can help to ensure that you receive a fair exchange rate and avoid any potential scams or fraudulent activities.

By following these tips, you can ensure that you get a fair exchange rate and avoid any potential scams or fraudulent practices when exchanging your money in Vietnam.

❓ Frequently Asked Questions – Money in Vietnam:

1. What is the official currency of Vietnam?

-

- The official currency of Vietnam is the Vietnamese Dong (VND). It is abbreviated as „đ“ and pronounced „dong“. Banknotes come in denominations of 1,000, 2,000, 5,000, 10,000, 20,000, 50,000, 100,000, 200,000, and 500,000 dong.

2. Can I use US dollars in Vietnam?

-

- While some places may accept US dollars, the official currency for transactions in Vietnam is the Vietnamese Dong. It is best to have Vietnamese Dong on hand for most transactions.

3. Where can I exchange currency in Vietnam?

-

- You can exchange currency at banks, exchange offices, and some hotels and airports in Vietnam. Banks typically offer better exchange rates than exchange offices or hotels.

4. Is it better to exchange currency in Vietnam or in my home country?

-

- It is usually better to exchange currency in Vietnam, as exchange rates can be better and you may be able to avoid fees that are charged in your home country. However, it is always a good idea to have some local currency with you before arriving in Vietnam.

5. Are credit cards widely accepted in Vietnam?

-

- Credit cards are accepted in some places in Vietnam, but cash is still the most widely used form of payment. Visa and Mastercard are the most widely accepted, with American Express and Discover being less common.

6. Are there ATMs in Vietnam that accept foreign cards?

-

- Yes, there are many ATMs in Vietnam that accept foreign cards, but be aware that some may charge fees. The most widely used ATMs are those operated by Vietcombank, Techcombank, and Agribank.

7. Can I use traveler’s checks in Vietnam?

-

- Traveler’s checks are not widely accepted in Vietnam, and it can be difficult to find a place to exchange them. It is better to bring cash or a debit/credit card.

8. How much money should I bring to Vietnam?

-

- The amount of money you should bring to Vietnam depends on your travel style and itinerary. It is recommended to have a mix of cash and cards, with enough cash to cover expenses like meals, transportation, and souvenirs. The average daily budget for a backpacker in Vietnam is around $20-30, while mid-range travelers can expect to spend around $50-80 per day. Luxury travelers can expect to spend upwards of $100 per day.

9. Is it customary to tip in Vietnam?

-

- Tipping is not a common practice in Vietnam, but it is becoming more common in tourist areas. If you do decide to tip, 5-10% is usually sufficient. However, tipping is not expected in most situations.

10. Can I bring Vietnamese Dong out of the country?

-

- There are no restrictions on taking Vietnamese Dong out of the country, but it may be difficult to exchange it back into your home currency in some countries. It is recommended to exchange any unused Vietnamese Dong back into your home currency before leaving Vietnam.

| Vietnam Money and Currency | Details |

|---|---|

| Currency | Vietnamese dong (₫, VND) |

| Symbol | ₫ |

| Subunit | Hào (1₫ = 10 hào) and Xu (1 hào = 10 xu) |

| Banknotes | 1,000₫, 2,000₫, 5,000₫, 10,000₫, 20,000₫, 50,000₫, 100,000₫, 200,000₫, 500,000₫ |

| Coins | 200₫, 500₫, 1,000₫, 2,000₫, 5,000₫ |

| Central Bank | State Bank of Vietnam (Ngân hàng Nhà nước Việt Nam) |

| Exchange Rate | Varies with respect to other currencies |

| Recommended for Tourists |

– It’s advisable to carry some Vietnamese dong for small expenses – Major hotels, restaurants, and tourist establishments accept credit cards – ATMs are widely available in cities and tourist areas for cash withdrawals – Be cautious of counterfeit currency, especially with larger denominations – Consider exchanging money at authorized banks or exchange counters |

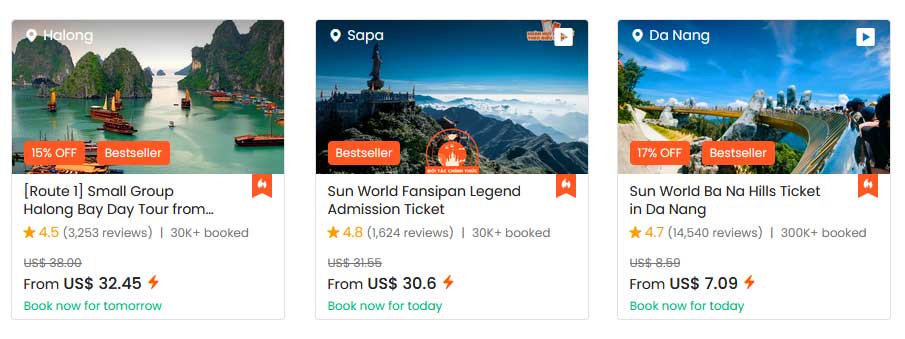

BOOK A TOUR / ACTIVITY in Vietnam ➜

| The Unique Aspects of Money in Vietnam: | Description |

|---|---|

| 1. Currency Diversity: |

Vietnam’s monetary landscape is characterized by a variety of banknotes and coins. The official currency is the Vietnamese đồng (VND), and while larger denominations exist, it’s common to see everyday transactions in the thousands. The intricate designs on the banknotes reflect Vietnam’s rich cultural heritage, featuring images of historical figures, landmarks, and symbols representing the country’s identity. |

| 2. Colorful Vietnamese Dong: |

The Vietnamese đồng comes in vibrant colors, making the currency visually distinctive. Each denomination has its unique color scheme, aiding both locals and visitors in quickly identifying the value of banknotes. From the striking red 500,000 VND note to the blue 10,000 VND note, the colors contribute to the diversity and artistic expression embedded in Vietnam’s currency. |

| 3. Cultural Depictions: |

Vietnamese banknotes serve as a canvas for cultural representations. The reverse sides often feature iconic landscapes, historical events, and traditional symbols. For example, the 200,000 VND note showcases the UNESCO-listed complex of My Son, highlighting the country’s rich archaeological heritage. The fusion of art and currency narrates a visual story of Vietnam’s diverse cultural tapestry. |

| 4. Historical Figures on Banknotes: |

Vietnamese banknotes prominently feature images of significant historical figures who played pivotal roles in the country’s development. Notable figures include Ho Chi Minh, the founding father of modern Vietnam, whose image adorns various denominations. The presence of historical figures on currency serves as a constant reminder of Vietnam’s struggle for independence and its enduring spirit. |

| 5. High Nominal Values: |

In Vietnam, it’s not uncommon to encounter banknotes with high nominal values. The 500,000 VND and 1,000,000 VND notes are frequently used in daily transactions, reflecting the country’s economic context. Carrying significant amounts of cash for routine expenses is standard practice, and the denominations facilitate convenient transactions, even for modest purchases. |

| 6. Coins for Small Change: |

While banknotes dominate larger transactions, coins are essential for smaller denominations. Coins come in various values, including 200 VND, 500 VND, 1000 VND, and 5000 VND. Locals and savvy travelers appreciate the convenience of coins for items like street snacks, transportation, and minor purchases. Embracing both banknotes and coins is integral to navigating Vietnam’s cash-centric economy. |

| 7. Cash Preference over Cards: |

While card payments are becoming more accepted in urban centers, cash remains the preferred method of payment throughout Vietnam. Many smaller establishments, street vendors, and local markets may only accept cash. ATMs are widely available, allowing travelers to withdraw đồng for daily expenses. Carrying sufficient cash ensures smooth transactions and accessibility in various settings. |

| 8. Currency Stability: |

The Vietnamese đồng has maintained relative stability in recent years, contributing to a reliable economic environment. The government’s efforts to manage inflation and stabilize the currency have bolstered confidence in the đồng. Travelers can navigate the country’s financial landscape with confidence, knowing that the currency’s value remains consistent for their transactions. |

| 9. Currency Exchange and ATMs: |

Currency exchange services and ATMs are readily available in major cities and tourist destinations. Travelers can exchange foreign currency for Vietnamese đồng at banks, exchange offices, or authorized currency exchange counters. ATMs accept major international credit and debit cards, providing convenient access to cash. It’s advisable to carry a mix of cash and cards for flexibility in different situations. |

| 10. Cultural Respect in Handling Money: |

Culturally, Vietnamese people treat money with respect, and visitors are encouraged to do the same. Handing money with both hands, particularly when making transactions with elders, is considered polite. Maintaining the cleanliness of banknotes is also a sign of respect. Understanding and adopting these cultural nuances add a layer of cultural immersion to the practical aspects of using money in Vietnam. |