1. Money in Thailand

2. Banknotes + Coins

3. Exchange in Thailand

4. Banks in Thailand

5. ATMs + Credit Cards

6. Things To Watch Out

7. Questions + Answers

Quick answer: The official currency in Thailand is the Thai baht (THB), and it’s used everywhere from big cities to small rural towns. While cash is still the most common payment method—especially in street markets, local shops, and food stalls—cards and mobile payments are increasingly accepted in malls, hotels, and tourist areas. Exchanging money is easy and safe when done at licensed money changers or banks, and ATMs are widely available across the country. Carrying a mix of cash and card payments ensures smooth travel wherever you go in Thailand.

At a glance:

- 💱 Currency Code: THB – Thai baht.

- 📌 Symbol: ฿ or “B” in prices.

- 📜 Denominations: Banknotes: ฿20, 50, 100, 500, 1000; Coins: 1฿, 2฿, 5฿, 10฿.

- 🏧 Cash & Cards: Cash is widely accepted, but credit/debit cards and mobile payments are also common.

- 💹 Exchange Tips: Use licensed money changers or banks for better rates – avoid airport counters if possible.

- 💡 TIP: ATMs are easy to find in cities; many support international cards.

Last updated in November 2025.

The official currency of Thailand is the Thai Baht (THB).

Thailand is a country that not only attracts millions of tourists with its hospitality but also boasts a unique currency that plays a crucial role in the economic framework of this picturesque and popular tourist destination. The Thai Baht, with the code THB, is an intriguing element of this exotic country.

History of the Baht: Journey from a silver unit to a stable currency

-

- The history of the Thai currency dates back to the 19th century during the reign of King Mongkut. The Baht got its name from a unit of silver that was once in circulation, and since then, it has undergone many transformations. The introduction of the Baht into circulation marked its closely intertwined journey with the history of the Kingdom of Thailand, eventually stabilizing in 1928 with the current name, the Thai Baht.

Design of Banknotes and Coins: Cultural Heritage and National Symbols

-

- The Thai Baht is not just a currency; it is also a bearer of the country’s cultural identity. Banknotes feature portraits of significant Thai kings, while coins are adorned with symbols of national landmarks. The overall visual impression of the currency reflects the richness and diversity of Thai heritage.

Stability of the Baht and Economic Growth: Key Element of Prosperity

-

- The Thai Baht is not just an aesthetic piece; it plays a key role in the economic development of the country. Its stability is influenced by various factors, such as foreign investments and mass tourism. The significance of the Baht on the international stage continues to grow, contributing positively to Thailand’s overall economic growth.

Thai Baht in Daily Life: Transactions and Stability of the country

-

- For local residents, the Thai Baht plays a crucial role in daily life. From small transactions to larger investments, the Baht is an integral part of the everyday financial system, providing stability and certainty.

What paper banknotes and coins are used in Thailand?

In Thailand, various denominations of paper banknotes and coins are in common circulation. The Thai currency, Baht (THB), is available in the form of banknotes and coins, each with different nominal values. Here are some of the commonly used paper banknotes and coins in Thailand:

💸 Paper Banknotes in Thailand:

-

- 20 Baht: The lowest denomination, often used for small purchases and transactions.

- 50 Baht: Another common value, frequently used in everyday shopping.

- 100 Baht: Medium-value banknote used for moderate to higher-value purchases.

- 500 Baht: Higher value found in circulation for larger-scale purchases.

- 1,000 Baht: The highest value of Thai banknotes, typically used for larger transactions and business operations.

🪙 Coins in Thailand:

-

- 1 Baht: The lowest value coin, commonly used for small purchases and transactions.

- 2 Baht: Another coin value found in circulation for smaller payments.

- 5 Baht: Higher-value coin suitable for moderate-value transactions.

- 10 Baht: Medium-high value coin commonly used in many daily transactions.

- Values above 10 Baht: Some larger value coins may exist, but they are less common.

Paper banknotes and coins in Thailand feature various designs and portraits of Thai kings, landmarks, and cultural symbols reflecting the richness and history of this picturesque country. These currencies are also collector’s items for many numismatics enthusiasts who appreciate the artistic elements and historical values associated with Thai currency.

💱 How to Exchange Money (US Dollars, Euros) in Thailand?

In Thailand, there are many places where you can exchange money, especially US dollars and euros. Most vendors primarily accept Thai Baht. Dollars may be accepted for activities like tours in tourist destinations, some modern hotels, etc. The following are common places for currency exchange:

-

- Banks in Thailand: Most banks in Thailand provide currency exchange services. Standard bank branches offer the exchange of various world currencies. Banks usually offer more favorable exchange rates compared to some other institutions.

- Currency Exchange Booths in Thailand: Exchange booths are commonly available at airports, train stations, tourist areas, and in major cities. You can exchange any currency for Thai Baht here. As a European tourist, it’s advisable to carry US dollars or euros. Exchange booths may have slightly different exchange rates, so comparing offers from different places is recommended.

- Hotels and Large Shopping Complexes: Some hotels and large shopping complexes may provide currency exchange services for their guests or customers. However, be aware that exchange rates may not always be the most advantageous.

- ATMs in Thailand: Payment cards are commonly accepted in many parts of Thailand, and you can use them to pay for most things. ATMs are also available, allowing you to withdraw cash in the local currency. However, be aware of withdrawal fees, which can range from 200-220 THB per transaction.

- Airports in Thailand: Airports are another place where you can exchange money in Thailand. Most international airports in Thailand provide currency exchange services in arrival and departure terminals. You can use either bank branches or exchange booths located directly at the airport. Airport exchange booths are often convenient for travelers needing local currency immediately upon arrival. However, exchange rates may be slightly less favorable compared to banks or some off-airport exchange booths. In any case, it’s useful to check the current exchange rates and fees at the specific airport. When choosing a place to exchange money, it’s important to consider not only exchange rates but also any transaction fees.

It is always recommended to compare exchange rates and fees at different locations and choose the option that provides the most favorable conditions. Also, remember to prioritize safety and avoid exchanges at unofficial places to minimize the risk of fraud.

🏦 What are the banks in Thailand?

In Thailand, there are several banks offering a wide range of banking services for local residents, businesses, and foreign visitors. Some of the major banks in Thailand include:

-

- Bank of Thailand (BOT): It is the central bank of Thailand responsible for regulating and supervising the country’s banking system. BOT plays a crucial role in monetary policy and economic management.

- Bangkok Bank: One of the largest and oldest banks in Thailand with an extensive branch network across the country. It provides a wide range of banking services, including personal accounts, loans, and business credit.

- Krungsri (Bank of Ayudhya): Belongs to a strong international consortium and offers comprehensive financial products, including credit cards, loans, and savings accounts.

- Kasikornbank (KBank): One of the leading Thai banks with a large branch network and a wide range of services for corporate and retail clients.

- Siam Commercial Bank (SCB): One of the oldest banks in Thailand offering comprehensive banking and financial services, including digital platforms.

- Krung Thai Bank (KTB): One of the largest banks in the country with over 70 years of history. It offers a wide range of services for businesses, individuals, and government institutions.

- TMB Bank: Specializes in services for small and medium-sized businesses and also has products for individuals. It collaborates with international banks.

- CIMB Thai Bank: Part of the international CIMB Group, providing banking services for various client segments.

- Thanachart Bank: Merged with Thai Military Bank (TMB Bank) and is now part of a new banking group called TMB Thanachart Bank.

This list may not be exhaustive as the banking sector in Thailand may undergo changes. When choosing a bank for your needs, consider various factors, including branch availability, services offered by the bank, and account and transaction fees.

What are the international banks in Thailand?

Several international banks operate in Thailand, providing banking and financial services for foreign clients, businesses, and expatriates. Some of the international banks in Thailand are:

-

- Citibank: Citibank has branches in several cities in Thailand, offering a wide range of banking and financial services for an international clientele.

- Standard Chartered Bank: Standard Chartered has a long history in Thailand and offers comprehensive banking services for individuals, corporations, and institutions.

- HSBC: HSBC is another international bank with a strong presence in Thailand, providing a broad spectrum of financial services for both businesses and individuals.

- ANZ Bank: The Australia and New Zealand Banking Group (ANZ) is also present in Thailand, offering banking services for international clients and businesses.

- Deutsche Bank: The German Deutsche Bank provides services in Thailand primarily for corporate and institutional clients.

- United Overseas Bank (UOB): This Singaporean bank also has branches in Thailand, offering banking and financial services for traders and individuals.

- Bank of China: Bank of China has branches in Thailand, providing services for traders and individuals, especially those with business relationships with China.

- KASIKORNBANK (KBank): Although a Thai bank, it collaborates with international partners and has several overseas branches, enabling it to serve the international clientele.

When choosing an international bank in Thailand, it’s important to consider what specific services and products they offer for your needs and also focus on branch availability in the area where you plan to stay.

🏧 ATMs and Debit / Credit Cards in Thailand:

ATMs are readily available in Thailand and accept most international debit/credit cards, such as Visa, MasterCard, American Express, and others. Here are some key details regarding ATMs and cards in Thailand:

ATMs in Thailand:

-

- Wide Availability: ATMs are widespread throughout the country and can commonly be found in cities, tourist destinations, shopping centers, and airports.

- Local Currency: Most ATMs in Thailand offer the option to withdraw cash in the local currency, Thai Baht (THB).

- Cash Withdrawal Fees: Some banks may charge cash withdrawal fees at ATMs, applying to both local and foreign users. It’s advisable to check your bank’s terms and potential fees before using a foreign ATM.

- Card Transactions: Many merchants, restaurants, and hotels accept card payments, reducing the necessity for cash. Card transactions are particularly common in tourist areas and major cities. However, it’s good to always have some local currency on hand.

Debit/Credit Cards in Thailand:

-

- International Cards: Most international debit/credit cards, including Visa, MasterCard, American Express, and others, are accepted at stores, restaurants, and hotels.

- Limited Acceptance: Some smaller shops and markets may have limited acceptance of cards, so it’s advisable to carry some cash as well.

- Foreign Usage Activation Check: Before traveling to Thailand, it’s recommended to check if your debit/credit card is activated for international use and inform your bank about your planned trip.

- Currency Conversion: When making card payments abroad, there might be an option for currency conversion. In some cases, it might be more advantageous to decline this conversion and let the transaction be processed in the local currency.

When using ATMs and debit/credit cards in Thailand, it’s always wise to be cautious about potential fees and inquire about your bank’s conditions before departure. In most tourist destinations and larger cities, you’ll have ample options for both cash withdrawals and card payments.

💳 Which Credit Cards Can You Use in Thailand?

Major international credit cards are commonly accepted in Thailand. Below are some of the most frequently accepted credit cards:

-

- Visa: Visa is one of the most widely used cards globally and is commonly accepted in most stores, hotels, restaurants, and ATMs in Thailand.

- MasterCard: MasterCard is another internationally recognized credit card and is widely accepted in Thailand.

- American Express: American Express is less widespread than Visa and MasterCard but is still accepted in some luxury and international establishments.

- JCB (Japan Credit Bureau): JCB, a Japanese credit card, has some acceptance in Thailand, especially in establishments catering to Japanese visitors.

- Diners Club: Although it may have more limited acceptance than some other cards, Diners Club can still be used in certain places in Thailand.

However, it’s important to be aware that the acceptance of credit cards may depend on the specific store or establishment, and not all cards will be accepted everywhere. Nevertheless, most international hotels, restaurants, and stores typically accept Visa and MasterCard without significant issues. Before traveling to Thailand, it’s also good to inform your bank about your planned trip to minimize potential payment or cash withdrawal issues from foreign ATMs.

Is It Possible to Use ATMs at Airports in Thailand?

Yes, most international airports in Thailand have accessible ATMs that allow cash withdrawals in the local currency, Thai Baht (THB). These ATMs are typically located in arrival and departure terminals and are accessible 24 hours a day. When using an ATM at the airport in Thailand, it’s important to keep a few things in mind:

-

- Types of Cards: Most international credit and debit cards, such as Visa, MasterCard, American Express, and others, are usually accepted at ATMs.

- Exchange Rate and Fees: Banks often apply exchange rates and fees for cash withdrawals. It’s advisable to inquire about your bank’s fees in advance and choose the currency conversion option during the transaction.

- Safety: When using an ATM at the airport or anywhere else, it’s crucial to be cautious and protect your banking details. Ensure that no one is observing your entered information and use ATMs located in secure and well-lit areas.

- International Usage Activation: Before traveling to Thailand, ensure that your credit or debit card is activated for international use. You should also inform your bank about your planned trip to prevent automatic blocks due to unusual transactions abroad.

Most airports in Thailand facilitate travelers‘ access to ATMs for cash withdrawals, offering a convenient way to obtain Thai Baht immediately upon arrival in the country.

Is it possible to exchange money at the airports in Thailand?

Yes, exchanging money at airports in Thailand is a common service for incoming travelers. At international airports such as Suvarnabhumi Airport in Bangkok or Phuket Airport, there are currency exchange booths that allow you to exchange foreign currencies for Thai Baht. The following information is important when exchanging money at the airport in Thailand:

-

- Opening Hours: Currency exchange booths at airports usually operate continuously and are open 24 hours a day. This allows travelers to exchange money even in the case of late-night arrivals.

- Exchange Rates: Currency exchange booths at airports typically offer reasonable exchange rates. However, it’s advisable to compare offers from different exchange booths or banks to get the best rate.

- Fees: Some exchange booths may charge fees for the transaction. It’s advisable to inquire about these fees in advance and choose an option with minimal costs.

- Types of Currencies: Currency exchange booths at international airports in Thailand usually accommodate most major world currencies, such as the US Dollar, Euro, British Pound, and others.

- Credit Cards: Some exchange booths at airports may also accept credit cards for currency exchange. However, it’s recommended to have cash as not all exchange booths accept credit cards.

Exchanging money at the airport can be a convenient way to obtain local currency upon arrival. Nevertheless, it’s important to be cautious and check exchange rates and fees to maximize the value of your exchange.

⚠️ Beware of Dynamic Currency Conversion (DCC).

-

- If you want to save money when exchanging money for Thai Baht, avoid Dynamic Currency Conversion (DCC). This is offered at many ATMs in Thailand and some retailers and hotels. If given the option to pay in your home currency, ignore it and choose Thai Baht (THB) instead. Although it may seem more convenient because you see how much you’re paying in your home currency (e.g., pounds or euros), it will almost always be at a much worse exchange rate than the standard rate.

ATM Withdrawal Fees in Thailand and Withdrawal Limits:

Fees for ATM withdrawals in Thailand may vary depending on your banking institution, account type, and the specific ATM you are using. Some banks may have agreements for reduced or no fees with certain banks in Thailand or global ATM networks. Here are some general pieces of information about ATM withdrawal fees in Thailand:

-

- Fees from Foreign Banks: Your home country bank may impose fees for ATM withdrawals abroad. These fees can either be a fixed amount or a percentage of the withdrawal and vary by bank.

- Fees from Local Banks: Some Thai banks may also charge their fees for ATM withdrawals for foreign customers. These fees are often disclosed before the withdrawal, giving you the option to confirm or decline.

- Withdrawal Limits: ATMs may have limits on the maximum cash withdrawal per transaction. These limits vary by bank and account type. Some ATMs may also have restrictions on the maximum daily withdrawal.

Examples of Thai ATMs:

-

- Bangkok Bank: With an extensive branch network, this bank has ATMs throughout the country. Fees may vary depending on your home bank.

- Krungsri Bank: Another bank with ATMs in most regions of Thailand. Similar to other banks, fees will depend on your home bank.

- Kasikornbank (KBank): As one of the largest banks in Thailand, Kasikornbank has widely available ATMs. Fees depend on the agreement between your home bank and KBank.

Approximately, expect the fee for withdrawing money from these ATMs to be around 200 to 220 Baht, roughly 100 Czech Koruna or slightly more. This amount is indicative and may vary over time and depending on the type and amount of withdrawal.

What to Watch Out for When Paying in Thailand?

When making payments in Thailand, it’s advisable to be cautious about several aspects:

-

- Safety of Credit Cards: Ensure that the card payment device looks secure and undamaged. Avoid skimming, which can be a risk in some less secure locations.

- Refusal of Currency Conversion: When paying with a credit card abroad, some establishments may ask if you want to pay in your home currency. This currency conversion may come with unfavorable exchange rates and fees. It’s better to decline this conversion and pay in the local currency.

- ATM Cash Withdrawals: When using ATMs, check the surroundings for safety and protect your PIN. Be aware of cash withdrawal fees, which may be imposed by both your home bank and the local bank.

- Exchange Rates: When exchanging money at currency exchange booths or banks, carefully check exchange rates and fees. Some establishments may present a favorable rate but include hidden charges.

- Verification of Amount in Account: After completing a transaction, verify your account or accounting to ensure correct amounts are charged.

- Payment at Unofficial Places: Be aware that open-air payments at unofficial places or markets may be more susceptible to fraud. Prefer official stores and use credit cards at places where they are accepted.

- Cautious Handling of Cash: When making cash payments, be cautious of change and keep your money in a secure place, especially in crowded or touristy areas.

When traveling and making payments in a foreign country, it’s always good to be vigilant and monitor your financial transactions to minimize the risk of fraud or misunderstandings.

❓ FAQ + TIPS – Money and Currency in Thailand:

1. What is the official currency in Thailand, and what is the exchange rate?

-

- The official currency in Thailand is Thai Baht (THB). Exchange rates may vary, but they commonly hover around 30 THB for 1 USD. It’s always good to check the current rates before traveling.

2. What are the available options for currency exchange in Thailand?

-

- Money exchange can be done at banks, currency exchange booths, and some hotels. Banks usually offer better rates but may charge transaction fees. Currency exchange booths are often open longer and have a faster process, but their rates may be less advantageous.

3. How widespread are ATMs in Thailand?

-

- ATMs are commonly available in larger cities and tourist destinations in Thailand. It is recommended to withdraw cash from ATMs affiliated with banks to minimize fees. It’s also essential to be aware of fees charged by both the home country’s bank and the bank in Thailand.

4. Where is the best place to exchange money for Thai Baht?

-

- It’s usually more advantageous to exchange money for Thai Baht directly in Thailand, either at banks or currency exchange booths with favorable rates. Exchange rates in the home country may be less favorable, with higher fees.

5. Does currency exchange to Thai Baht have any specific rules?

-

- When exchanging money, it’s good to have valid identification documents, such as a passport. Some currency exchange booths may require you to fill out a form, especially for larger transactions. It’s advisable to monitor current rates and avoid exchange booths with unfavorable conditions.

6. How do credit card payments work in Thailand?

-

- Acceptance of credit cards is common in tourist areas, hotels, and larger stores and restaurants. In smaller towns and markets, cash may be the preferred payment method. It’s advisable to always have enough cash for small purchases and local establishments.

7. Are there common payment apps and mobile payments in Thailand?

-

- In Thailand, payment apps are becoming increasingly popular, especially in urban areas. Popular apps include GrabPay, Line Pay, or TrueMoney Wallet, commonly used for transportation, food, or online purchases.

8. How to avoid scams and safely use ATMs and cards in Thailand?

-

- It’s essential to withdraw cash only from official ATMs, avoid using ATMs in deserted areas, and be vigilant when entering your PIN. When paying by card in restaurants or shops, it’s recommended to use verified devices and check the receipt before leaving the premises.

9. Do hotels or accommodations in Thailand have any specific rules?

-

- Most hotels in Thailand require a credit card or cash for deposit payment for additional services or damages during check-in. Some hotels may also charge fees for card payments. It’s advisable to read the rules and conditions before making a reservation.

10. Does Thailand have any specific tax rules or fees for tourists?

-

- Thailand does not impose special tax fees on tourists for financial transactions. However, regular exchange fees may apply when exchanging money. Tourists should be cautious and check fees before making a transaction.

11. Any recommendations for handling cash and credit cards in smaller towns?

-

- In smaller towns and rural areas, credit card acceptance may be more limited. It’s advisable to have enough cash, especially if planning to visit remote areas. Some small shops and markets may only accept cash.

12. Does Thailand have any rules regarding the import or export of foreign currency?

-

- Thailand has no strict rules regarding the import or export of foreign currency for tourists. However, it’s always good to be cautious when carrying larger amounts of money and inquire about current rules before traveling.

13. What is the procedure for loss or theft of a payment card in Thailand?

-

- In case of loss or theft of a payment card in Thailand, it’s crucial to immediately contact the bank and block the credit card. Informing local police and obtaining a police report is also key to resolving the situation. Tourists should also contact their home country’s bank and inform them of the situation. Recording card blocking contacts and taking immediate action are crucial to minimizing financial losses.

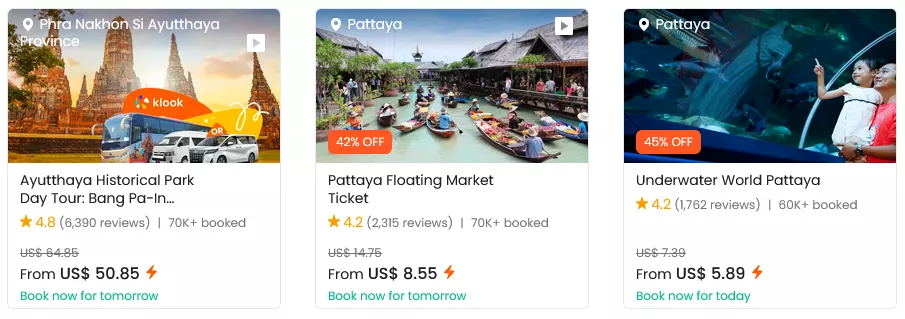

BOOK a TOUR / ACTIVITY in Thailand ➜

Money in Laos|Money in Cambodia|Prices in Laos|Prices in Cambodia|Prices in Malaysia|Souvenirs from Laos|Interesting Facts about Laos