1. Money in Singapore

2. Banknotes + Coins

3. Exchange in Singapore

4. Banks in Singapore

5. ATMs + Cards

6. What to Watch Out For

7. Questions + Answers

The official currency of Singapore is the Singapore Dollar (SGD).

Singapore, a small island state in Southeast Asia, boasts not only impressive architecture and cultural richness but also a robust economy. A crucial component of this economy is its currency, playing a key role in global trade and financial transactions. Let’s delve into the history, description, and evolution of the Singaporean currency.

History of the Singaporean Currency: Journey from the Malayan Dollar

-

- Originally part of Malaysia, Singapore shared a common currency – the Malayan Dollar. However, in 1965, when Singapore became an independent state, it parted ways with this currency. Singapore quickly gained a reputation as a global financial player, necessitating the need for its own currency.

Description of the Singaporean Currency: Symbol of Stability and Innovation

-

- The Singaporean currency, known as Singapore Dollar (SGD), has become a symbol of stability and innovation. Its design reflects the diversity of Singaporean culture and traditions, making each banknote and coin visually intriguing. The Singapore Dollar also boasts security features that protect it from counterfeiting, a crucial factor in today’s globalized world.

Evolution of the Singaporean Currency: Adapting to Modern Financial Trends

-

- The Singapore Dollar has not lagged in development and modernization. The introduction of electronic payment systems and digital currency has strengthened its position in fintech innovations. Singapore has thus become one of the leading global centers for fintech and blockchain technologies, reflecting the use of modern payment methods in the local economy.

Singapore Dollar in Global Trade: International Significance and Influence

-

- Despite its relatively small size, the Singapore Dollar has become a significant player in global trade. Singapore, with one of the highest GDPs per capita, maintains a strong position in international trade and investments, further bolstering the significance of its currency. Singapore is also among the wealthiest countries globally and is popular among tourists.

What Banknotes and Coins are Used in Singapore?

In Singapore, banknotes and coins are used as everyday currency. The currency of Singapore is known as the Singapore Dollar (SGD), and it has its own design reflecting the wealth and diversity of Singaporean culture. Here’s an overview of the banknotes and coins commonly used in Singapore:

💸 Paper Banknotes in Singapore:

-

- Banknotes come in various denominations, including 2, 5, 10, 50, 100, and 1000 dollars.

- Each banknote is designed with consideration for security features and aesthetics, featuring portraits of notable figures, images of cultural and historical symbols, and other artistic elements.

- Banknotes of 1000 dollars are no longer issued but may still be in circulation.

🪙 Coins in Singapore:

-

- Coins circulate in denominations of 1, 5, 10, 20, and 50 cents, and 1 dollar.

- They come in various sizes, shapes, and designs. Images on coins may include city symbols, plants, or other symbols associated with Singapore.

Security Features of Banknotes:

- Holographic Elements: Some banknotes feature holographic elements as security measures against counterfeiting.

- Watermarks: Most banknotes include watermarks that are visible when the banknote is held up to light.

- Embossed Printing: Some parts of banknotes may have embossed prints that are tactile to touch.

Non-Cash Payments in Singapore:

In Singapore, non-cash payments are very common. Credit cards, debit cards, mobile payments, and other electronic transaction forms are utilized. This modern payment infrastructure contributes to the convenience and efficiency in the daily lives of residents.

How and What Currency to Exchange in Singapore?

In Singapore, you can exchange currency at various locations, both upon arrival and during your stay. Many foreign currencies, including US Dollar, Euro, British Pound, Australian Dollar, and others, can be exchanged in banks, exchange offices, and some stores. Here are some ways to exchange currency in Singapore:

1. Airport Currency Exchange in Singapore:

-

- Upon Arrival: Changi International Airport in Singapore has currency exchange facilities where you can exchange money upon arrival.

2. Banks in Singapore:

-

- Bank Branches: Singapore has many bank branches that offer currency exchange services. Opening hours may vary but are usually on weekdays.

3. Currency Exchange Offices in Singapore:

-

- Independent Exchange Offices: Apart from airports and banks, there are standalone exchange offices that may offer competitive exchange rates. Some may have extended operating hours compared to banks.

4. Hotels and Shopping Centers:

-

- Larger Hotels: Some larger hotels in Singapore provide currency exchange services for their guests.

- Shopping Centers: Some larger shopping centers may have exchange offices or bank branches where you can exchange money.

Tips for Currency Exchange in Singapore:

-

- Check Exchange Rates: Before exchanging money, review exchange rates to get the most favorable rate.

- Use ATMs: Many ATMs in Singapore accept international cards. Withdrawing from an ATM might be more advantageous than exchanging at a regular exchange office.

- Credit Card Payments: In Singapore, credit and debit cards are widely accepted. Many shops and restaurants offer cashless payment options.

- Check Fees: Before exchanging money or withdrawing from an ATM, check possible transaction fees to avoid unexpected charges.

Singapore is known for its high security, so currency exchange should be secure and reliable. Nevertheless, it’s always good to be cautious and choose reputable exchange offices or banks.

What are the Local Banks in Singapore?

Singapore is home to several prestigious and stable banks offering a wide range of banking products and services. Some of the main local banks in Singapore include:

-

- DBS Bank (Development Bank of Singapore): DBS is the largest bank in Singapore and one of the largest in Asia. It provides a comprehensive range of services, including accounts, loans, investment products, and other financial services.

- OCBC Bank (Oversea-Chinese Banking Corporation): OCBC is another significant bank in Singapore with a rich history. It offers services from regular accounts to investments and wealth management.

- UOB (United Overseas Bank): UOB is one of the oldest banks in Singapore with a strong presence in the region. It specializes in a wide range of financial products for individuals and businesses.

- Maybank (Malayan Banking Berhad): Maybank has a branch in Singapore and is known for its banking and financial services for both individuals and businesses.

- Standard Chartered Bank: Although originally from the UK, Standard Chartered has a significant presence in Singapore, providing extensive banking and financial services.

- RHB Bank: RHB Bank is a Malaysian bank with a presence in Singapore, offering banking and financial products for individuals and businesses.

This is just a list of some main local banks in Singapore, and there are also several smaller banks and specialized institutions providing various financial services. Each of these banks has its own advantages and specialties, so the choice depends on individual needs and preferences.

What are the International Banks in Singapore?

Singapore is a global financial center, hosting numerous international banks that offer a broad range of banking and financial services. Some of the international banks with a presence in Singapore include:

-

- CitiBank: The American global bank Citibank has a strong presence in Singapore, providing various banking and financial services for individuals and businesses.

- HSBC (Hongkong and Shanghai Banking Corporation): HSBC is one of the largest international banks globally and has an extensive branch in Singapore. It offers global banking and financial services for clients.

- Standard Chartered Bank: Standard Chartered has its main branch in London but is known for its presence in Singapore, where it provides a wide range of financial services.

- Bank of America Merrill Lynch: Bank of America Merrill Lynch, one of the largest banks in the United States, has a branch in Singapore specializing in investment banking.

- Credit Suisse: The Swiss bank Credit Suisse is internationally renowned and has a branch in Singapore offering services in private banking, wealth management, and more.

- UBS (Union Bank of Switzerland): Another Swiss bank, UBS, has a branch in Singapore and is known for its services in private banking and wealth management.

- BNP Paribas: The French bank BNP Paribas has a branch in Singapore, providing a wide range of financial services for individuals and businesses.

- Deutsche Bank: The German Deutsche Bank has a presence in Singapore, offering international banking and financial services for its clients.

This is just a list of some international banks with branches in Singapore, and there may be other smaller banks. These institutions focus on various areas, including private banking, wealth management, investment banking, and other services.

ATMs and Payment Cards in Singapore:

In Singapore, ATMs are readily available, and payment cards are widely accepted. Here is some information about ATMs and payment cards in Singapore:

🏧 ATMs in Singapore:

-

- ATM Networks: ATMs are widespread in Singapore and are available throughout the city. Major banks such as DBS, OCBC, UOB, and others have their ATMs.

- International Cards: International cards, such as Visa, MasterCard, American Express, and others, are commonly accepted at ATMs in Singapore.

- Exchange Offices: Some ATMs are located near exchange offices, which can be convenient for tourists needing to exchange currency.

- Contactless Withdrawals: Some banks in Singapore allow contactless withdrawals from ATMs using mobile payment apps or special cards.

💳 Payment Cards in Singapore:

-

- General Acceptance: Most shops, restaurants, and hotels in Singapore accept payment cards, especially Visa and MasterCard. American Express and others may be accepted at some locations.

- Contactless Payments: Contactless payments using cards or mobile payment apps are common and can expedite the payment process.

- Local Cards: Singaporean banks issue local debit cards used for regular payments and ATM withdrawals.

- Exchange Offices and Hotels: Payment cards are usually accepted in exchange offices and larger hotels.

- Mobile Payments: Mobile payment apps such as Apple Pay, Google Pay, and Samsung Pay are also available and can be used in many stores.

Tips for Payment Cards in Singapore:

-

- Ensure that your payment card is activated for international transactions before traveling.

- Check if you have sufficient funds for potential ATM withdrawal fees.

- Security measures, such as PIN codes and SMS verification, are common when using payment cards abroad.

Payment cards are a highly convenient way to pay in Singapore, and they are widely utilized by both tourists and locals.

Which Credit Cards Can You Use in Singapore?

In Singapore, most major international credit cards are accepted and widely used. Below are some of the most commonly accepted credit cards in Singapore:

-

- Visa: Visa is one of the most widely accepted credit cards globally and is widely recognized in Singapore. Most shops, restaurants, hotels, and ATMs accept Visa cards.

- MasterCard: MasterCard is another highly utilized credit card in Singapore. Similar to Visa, it is accepted in the majority of shops and establishments.

- American Express: American Express (Amex) cards are also accepted in many shops and restaurants in Singapore. However, some smaller businesses may have limited Amex acceptance.

- Diners Club: Diners Club cards may be accepted in some luxury restaurants and stores but might not be as universally accepted as Visa or MasterCard.

While most shops and businesses in Singapore accept credit cards, it’s always advisable to have some cash, especially in smaller places or traditional neighborhoods. Before traveling, it is also recommended to check the validity and availability of your credit card for international transactions.

Is It Possible to Use an ATM at Singapore Airport?

Yes, it is possible to use ATMs at Changi International Airport in Singapore. Changi Airport is one of the most modern and largest airports globally, well-equipped with ATMs and other financial facilities for obtaining cash or conducting banking transactions.

At Changi Airport, you’ll find ATMs from various banks, including major Singaporean banks (DBS, OCBC, UOB), as well as ATMs associated with international networks such as Visa, MasterCard, American Express, and others. These ATMs are usually located in key areas of the airport, including arrival and departure halls, shopping areas, and transit zones.

If you plan to use an ATM at the airport, it is recommended to check with your bank whether your credit or debit card is activated for international withdrawals. You can also obtain information from your bank about possible current fees that may be charged for transactions abroad.

Can You Exchange Money at Singapore Airports?

Yes, at Singapore’s Changi International Airport, money exchange is possible. Changi Airport is well-equipped with currency exchange services for travelers, and these exchange counters are typically located in various parts of the airport, including arrival and departure halls, shopping areas, and transit zones.

Airport exchange counters usually facilitate the exchange of major world currencies such as the U.S. Dollar (USD), Euro (EUR), British Pound (GBP), and others. Some exchanges may also offer currency exchange services for the local currency, the Singapore Dollar (SGD), or other regional currencies.

It’s always advisable to compare exchange rates and fees before exchanging money at the airport. In some cases, it might be more advantageous to exchange currency in the city at banks or currency exchange offices, where more favorable rates may be offered. Nevertheless, having the option to exchange money directly at the airport is convenient, especially if you need cash immediately upon arrival.

ATM Withdrawal Fees in Singapore and Withdrawal Limits:

ATM withdrawal fees in Singapore and withdrawal limits can depend on specific banks and the types of cards you use. Here are general details, but it’s always recommended to check your specific bank’s terms in advance:

ATM Withdrawal Fees:

-

- Bank fees: Some banks may charge fees for ATM withdrawals. These fees can range from 2 SGD to 5 SGD per transaction, especially when using ATMs outside your bank’s network.

- International fees: Using an international credit or debit card may result in international transaction fees. These fees can range from 1% to 3% of the transaction amount.

- ATM surcharge fees: Some ATMs may charge fees for cash withdrawals. These fees can range from 1 SGD to 3 SGD per transaction.

Withdrawal Limits:

-

- Daily limits or transactions: Banks may set limits for the maximum amount you can withdraw from an ATM in one day or one transaction. These limits can range from 1,000 SGD to 5,000 SGD.

- Foreign ATM withdrawal limits: Some banks may have special limits for withdrawals from ATMs outside their network. These limits may be set at 500 SGD to 2,000 SGD.

- International ATM withdrawal limits: Limits for withdrawals from international ATMs may vary based on the card type and the bank. These limits can be set in the range of 500 SGD to 3,000 SGD per transaction.

What to Watch Out for When Paying in Singapore?

When making payments in Singapore, it’s good to be cautious and keep in mind a few tips to minimize risks and ensure secure transactions. Here are some things to be mindful of:

1. Check credit and debit cards: Before using credit or debit cards, check your bank’s terms regarding international transactions and fees. Note that some banks may charge fees for ATM withdrawals abroad.

2. Contactless payments: When using contactless payment cards, be aware of the limits for this payment method. Some banks may set limits for the maximum amount for contactless payments.

3. Exchange Rates: When exchanging money at currency exchange counters, pay attention to exchange rates and any associated fees. Sometimes, it might be more advantageous to exchange money at banks or larger exchange offices.

4. Cash in taxis: When using taxis, verify in advance what payment options they accept. Some taxis may only accept cash.

5. Caution with uncovered PIN entry: When entering your PIN at an ATM or making payments in public places, ensure that you cover your PIN to prevent unauthorized observation.

6. Scams and theft: In busy places like shopping malls or markets, be cautious with your valuables and keep them secure.

7. Payment apps: If using mobile payment apps, ensure you have a secure connection and use trustworthy apps.

8. Declined transactions: If a transaction is declined, it may be due to your card being blocked for potential unauthorized activity. In such cases, contact your bank.

❓ FAQ + TIPS – Money and Currency in Singapore:

1. What is the currency in Singapore, and what is the current exchange rate?

-

- In Singapore, the official currency is called Singapore Dollar (SGD). The current exchange rate may vary depending on current economic conditions. It is recommended to check the latest exchange rates at currency exchange offices or banks before conducting financial transactions.

2. Are ATMs available in Singapore, and what are the usage fees?

-

- In Singapore, ATMs are widely available. Most ATMs allow cash withdrawals using cards. Fees for cash withdrawals may vary depending on the type of card and the bank operating the ATM. It is advisable to inquire about fees with your bank in advance.

3. What is the situation with cashless payments in Singapore?

-

- In Singapore, cashless payments are common, and cards are widely accepted in shops, restaurants, and tourist attractions. Most merchants accept international payment cards, but it’s good to have some cash on hand in case a particular establishment does not accept cards.

4. Can I use my domestic debit/credit card in Singapore?

-

- Most international payment cards are accepted in Singapore, eliminating the necessity of opening a local bank account. However, for an extended stay, having a local bank account may be advantageous for easier financial management and transfers.

5. Are there any specific security measures for card payments in Singapore?

-

- Singapore places a high emphasis on the security of payment transactions. Modern contactless payments are frequently used, and some cards may require verification through a PIN code. It is important to adhere to security measures such as safeguarding your PIN and monitoring bank statements.

6. Are there any fees for using credit cards in Singapore?

-

- Fees for using credit cards may vary among banks in Singapore. Some banks may charge an annual fee for card ownership, while others may offer cards with no annual fees. It is advisable to compare offers from different banks before obtaining a credit card.

7. What are recommended measures to protect against fraudulent transactions?

-

- To protect against fraudulent transactions, it is important to maintain card security measures, such as not disclosing the PIN code or CVV number to unauthorized individuals. Regularly monitor bank statements and promptly report any unauthorized transactions to your bank.

8. What are the typical costs for dining and accommodation in Singapore?

-

- Costs for dining and accommodation in Singapore can vary depending on the location and level of luxury. Most restaurants and hotels accept card payments, but it’s also advisable to have some cash for smaller establishments or markets that may prefer cash payments.

9. Are currency exchange counters available in Singapore?

-

- Currency exchange counters are commonly available in tourist areas and at the airport in Singapore. Exchange fees may depend on the specific exchange office, so it is recommended to compare offers. Some exchange offices may charge fixed fees, while others may have percentage-based fees on the total exchanged amount.

10. What is the security situation at ATMs in Singapore?

-

- ATMs in Singapore are usually secure, but it’s always good to be cautious. To guard against skimming, try to withdraw cash from ATMs located in safe and well-lit areas. Regularly check your bank statements and report any suspicious transactions to your bank.

11. Are there any tax obligations or limits for tourists in Singapore?

-

- There are no specific tax obligations for tourists in Singapore related to currency exchange or purchases. However, luxury items may be subject to taxation when purchased. It’s always good to inquire in advance about taxes associated with certain purchases.

12. What are the usual opening hours of banks and exchange offices in Singapore?

-

- Opening hours of banks and currency exchange offices may vary, but most banks have standard operating hours from Monday to Friday. Some currency exchange offices may have extended hours, especially in tourist areas. If planning to exchange larger amounts, providing identification documents and reporting transactions may be required.

13. What is the policy regarding tipping in restaurants and services in Singapore?

-

- Tipping is not mandatory in Singapore as many restaurants already include service charges in the bill. However, if satisfied with the service, rounding up the bill or leaving a small tip is common. In some cases, a „service charge“ item may already cover the service.

14. What are the recommendations for securing finances and valuables in Singapore?

-

- When traveling in Singapore, it is important to keep financial resources and valuables secure. Use security belts or wallets with zippers to prevent unauthorized access. Be mindful of your personal belongings in crowded areas and avoid dark streets at night. It is also advisable to record card numbers and contact the bank’s information in case of theft or loss.

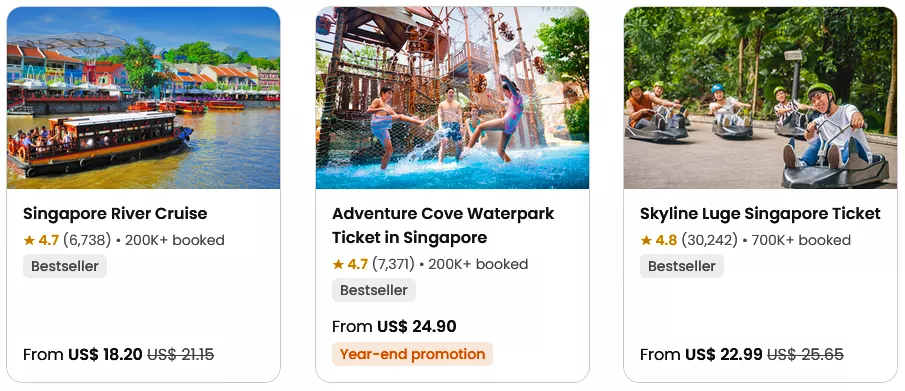

BOOK a TOUR / ACTIVITY in Singapore ➜

Culture in Thailand|Food / Cuisine in Thailand|Food / Cuisine in Laos|Food / Cuisine in Cambodia|Food / Cuisine in Malaysia|Money in Laos