1. Money in Malaysia

2. Banknotes + Coins

3. Exchange in Malaysia

4. Banks in Malaysia

5. ATMs + Cards

6. Things to Watch Out

7. Questions + Answers

Quick answer: Malaysia’s currency is the Malaysian ringgit, abbreviated as MYR and symbolized by RM. It is widely used throughout the country for everyday transactions, from street food to shopping malls. The ringgit is a stable currency managed by the central bank, and both cash and electronic payments are commonly accepted, especially in urban areas.

At a glance:

- 💱 Currency Code: MYR – Malaysian ringgit.

- 📌 Symbol: RM, used in pricing and payments.

- 📜 Subunit: 100 sen equals 1 ringgit, with coins in various denominations.

- 💵 Banknotes: Available in RM1, RM5, RM10, RM20, RM50, and RM100 notes.

- 🪙 Coins: Commonly used coins include 5 sen, 10 sen, 20 sen, and 50 sen.

- 🏦 Central Bank: Issued and regulated by Bank Negara Malaysia.

- 🔄 Exchange Rate: The ringgit operates on a managed float system, maintaining relative stability.

- 💡 Payment Tips: Credit cards and mobile payments are widely accepted in cities, but carrying some cash is helpful for rural areas and markets.

Last updated in November 2025.

The official currency of Malaysia is the Malaysian Ringgit (MYR).

Malaysia, a magical land rich in cultural diversity, exotic nature, and historical heritage, is not only a tourist paradise but also home to a unique currency – the Malaysian Ringgit. This currency is not just a medium of exchange; it carries stories of Malaysia’s history, traditions, and economic development on its banknotes and coins. Looking at the Malaysian Ringgit opens a window into the past, present, and future of this enchanting Southeast Asian country.

History of the Malaysian Currency: Roots and Transformations

The Malaysian Ringgit has deep roots in the history of the Malayan Federation, founded in 1948. The original currency was the Malayan dollar banknote, which circulated until 1953. After Malaysia gained independence in 1957, the process of creating its own currency reflecting the new national character began.

In 1967, the first Malaysian Ringgit was introduced, replacing the previous currency. The name „ringgit“ itself comes from a Malay word meaning „sharp,“ which could be a metaphor for economic strength. Over the years, the ringgit underwent several reforms to adapt to changing economic conditions and solidify its position as a strong and stable currency in the region.

Design and Description of the Currency: Artistic Flair and Security Features

The Malaysian Ringgit is not just a practical tool for transactions; it is also a masterpiece of visual art. Banknotes are adorned with images of significant figures from Malaysian history, colorful patterns, and scenes reminiscent of the country’s cultural and natural wealth.

An interesting feature of the Malaysian currency is its security elements, including holographic strips, watermarks, and other technologies, enhancing resistance to counterfeiting. Each banknote represents a blend of aesthetics, history, and modern security features.

Economic Development and Stability: Ringgit as an Indicator of Prosperity

The Malaysian Ringgit plays a key role in the country’s economy, evolving into one of the leading economies in Southeast Asia. Since its introduction, the ringgit has experienced stages of value stability, constantly reflecting Malaysia’s economic growth and progress. In recent decades, the Malaysian economy has transformed from an agrarian system into an industrial and technological hub, evident in the currency’s development.

Future of the Malaysian Ringgit: Global Challenges and Innovation

The world economy is constantly changing, bringing challenges for individual currencies. The Malaysian Ringgit looks to the future with a commitment to remain a strong and competitive player on the global stage. Innovations in payment technologies and economic models become crucial factors shaping the next chapters in the story of this currency.

What banknotes and coins are used in Malaysia?

In Malaysia, banknotes and coins are used as common currency in shops, markets, malls, and anywhere cash is accepted. The Malaysian Ringgit (MYR) is the official currency of the country, and its symbol is RM. Here is an overview of the banknotes and coins used in Malaysia:

💸 Paper Banknotes in Malaysia:

-

- Circulating banknotes:

- 1 ringgit, 5 ringgit, 10 ringgit, 20 ringgit, 50 ringgit, 100 ringgit

- Material and design:

- Banknotes are printed on polymer material, enhancing their durability and longevity.

- Each banknote features a unique design with a portrait of a significant figure from Malaysian history, symbols of national heritage, and various color elements.

- Security features:

- Banknotes include modern security features such as holographic strips, watermarks, microtext, and others to protect against counterfeiting.

- Circulating banknotes:

🪙 Coins in Malaysia:

-

- Circulating coins:

- 1 sen, 5 sen, 10 sen, 20 sen, 50 sen, 1 ringgit

- Material and design:

- Coins are typically made of metals such as nickel, copper, and zinc.

- Each coin features a portrait of a king or national symbols on one side, while the other side depicts various motifs reflecting Malaysia’s cultural and natural wealth.

- Values and dimensions:

- Coin values are fixed and are usually used for small transactions.

- The dimensions of the coins vary based on their values, making identification easy for daily use.

- Circulating coins:

Non-cash Payments in Malaysia:

In addition to cash transactions, non-cash payments, including payment cards and electronic payment systems, are becoming increasingly popular in Malaysia. This allows citizens and visitors to conduct transactions easily and efficiently within a modern financial environment.

Where and How to Exchange Money in Malaysia?

In Malaysia, you can exchange money at several locations, including airports, banks, exchange offices, and some hotels. For exchanging money into Malaysian Ringgit, you can use internationally recognized currencies, primarily the US Dollar, to a lesser extent, the Euro or Australian Dollar. The following are common places where you can exchange money in Malaysia:

1. Banks:

-

- Local Banks: Most local banks in Malaysia offer currency exchange services, including major urban branches and branches in tourist areas.

- International Banks: Some international banks may also provide currency exchange or offer banking services for tourists.

2. Exchange Offices:

-

- City Exchange Offices: Larger cities and tourist centers have exchange offices where you can exchange money with the usual fee.

- Exchange Offices in Shopping Centers: Some exchange offices are located in shopping centers or tourist-frequented areas.

3. Airports:

-

- Airport Exchange Offices: Upon arrival in Malaysia, you can exchange money at the airport. Keep in mind that exchange rates at airports may be slightly less favorable than at city exchange offices.

4. Hotels and Resorts:

-

- Hotel Exchange Services: Some hotels and resorts may offer currency exchange services for their guests. Note that exchange rates may not be as advantageous as in other establishments.

5. Payment Cards and ATMs:

-

- ATMs: Malaysia is well-equipped with ATMs that allow cash withdrawals in the local currency. Card payments can be made at many shops and restaurants.

Some Tips for Money Exchange in Malaysia:

- Compare Exchange Rates: Different places may offer different exchange rates, so it’s good to compare offers and choose the most advantageous option.

- Fees and Rates: Keep in mind that some places may charge fees or offer less favorable exchange rates, which can affect the final amount you receive.

- Card or Cash: Many places in Malaysia accept payment cards, but it’s also good to have some cash on hand for cases when cards are not accepted.

- Opening Hours: Banks and exchange offices have their opening hours, and these may vary. Pay attention to the time and location to exchange money without any issues.

Remember that when traveling abroad, it may be beneficial to have a combination of Malaysian Ringgit in cash and credit/debit cards for greater flexibility. More remote areas may only accept cash.

What are the Banks in Malaysia?

In Malaysia, several significant banks provide extensive banking and financial services for citizens and businesses. Here are some of the main Malaysian banks:

- Maybank (Malayan Banking Berhad): Maybank is one of the largest and oldest banks in Malaysia, offering a wide range of banking and financial services, including accounts, loans, credit cards, and investment products.

- CIMB Bank (CIMB Group): CIMB is an international banking group with extensive operations in Southeast Asia. In Malaysia, it is one of the major banks providing services such as accounts, loans, and investment options.

- Public Bank Berhad: Public Bank is known for its branch network and a wide range of services for Malaysian citizens and businesses. It provides services such as accounts, loans, credit cards, and investment products.

- RHB Bank Berhad: RHB Bank is another significant Malaysian bank offering a broad range of services, including personal and corporate accounts, loans, and other financial products.

- Hong Leong Bank Berhad: Hong Leong Bank is an international bank with branches in several Asian countries. In Malaysia, it provides various banking services for individuals and businesses.

- AmBank (Alliance Bank Malaysia Berhad): AmBank is one of the leading banks in Malaysia, offering a wide spectrum of financial services, including banking and investment products.

- Affin Bank Berhad: Affin Bank is a comprehensive bank providing banking and financial services, focusing on personal and corporate banking.

These are just some of the main banks in Malaysia, and there are other banks and institutions providing various banking and financial services in the country.

What are the International Banks in Malaysia?

Several international banks are present in Malaysia, offering banking and financial services for local residents, businesses, and international clients. Some of these international banks include:

- HSBC (Hongkong and Shanghai Banking Corporation): HSBC is one of the largest international banks with a branch in Malaysia. It provides a wide range of services, including personal and corporate banking, investment products, and international trade.

- Standard Chartered Bank: Standard Chartered has a strong presence in Malaysia, offering various banking and financial products, including current accounts, credit cards, loans, and wealth management.

- Citibank: Citibank also has branches in some cities in Malaysia, providing services such as accounts, cards, mortgages, and other banking products for individuals and businesses.

- ANZ Banking Group: Australia and New Zealand Banking Group has branches in some parts of Malaysia, focusing mainly on corporate and business banking.

- Mizuho Bank: Japanese Mizuho Bank has branches in Kuala Lumpur and offers banking services for businesses and corporations in the region.

- Deutsche Bank: Deutsche Bank is an international bank with a presence in Malaysia, focusing primarily on corporate banking and financial services.

- UOB (United Overseas Bank): UOB, headquartered in Singapore, has branches in Malaysia, providing personal and business banking, investments, and other financial products.

- BNP Paribas: The French bank BNP Paribas has branches in Malaysia, offering extensive banking and financial services for local clients.

These international banks provide a wide range of services following international standards and are often the preferred choice for those with international financial needs. When choosing a bank, it’s essential to consider your specific requirements and preferred services.

ATMs and Debit / Credit Cards in Malaysia:

In Malaysia, there is an extensive network of ATMs, and debit/credit cards are widely accepted in cities, shops, and restaurants. Below are key pieces of information about ATMs and payment cards in Malaysia:

🏧 ATMs in Malaysia:

-

- Wide Network: ATMs are commonly available in all major cities and tourist destinations. They are often found in shopping centers, airports, train stations, and near bank branches.

- Types of ATMs: Most ATMs allow withdrawals in the local currency, Malaysian Ringgit (MYR). Some ATMs may also allow withdrawals in other currencies but with conversion fees.

- International Card Support: International payment cards like Visa, MasterCard, American Express, and others are typically accepted at most ATMs.

- Withdrawal Fees: Most ATMs usually charge fees for cash withdrawals. This information will be displayed by the ATM before completing the transaction.

- Security Measures: ATMs are usually located in secure areas, although it’s always good to be cautious, especially at night.

💳 Debit / Credit Cards in Malaysia:

-

- Acceptance of Payment Cards: Debit/credit cards are commonly accepted in most shops, restaurants, hotels, and tourist attractions.

- Types of Payment Cards: Visa and MasterCard are the most commonly accepted payment cards. American Express may be less frequently accepted.

- Payment Terminals: Payment terminals are commonly available in most places, allowing for contactless payments.

- Cashback: Some stores and supermarkets allow customers to receive cashback when paying with their debit/credit card.

- Security Measures: It is important to adhere to security measures such as hiding the PIN code and monitoring transactions on account statements.

- Contact Your Bank: Before traveling to Malaysia, it’s advisable to contact your bank and inform them about planned transactions abroad to ensure any security measures are lifted.

Which Credit Cards Can You Use in Malaysia?

In Malaysia, credit cards are commonly accepted, and you can use most international payment cards. Here are some of the most frequently accepted credit cards in Malaysia:

-

- Visa: Visa is one of the most widely used cards in Malaysia and is accepted in most stores, restaurants, hotels, and ATMs.

- MasterCard: MasterCard is also widely accepted throughout the country. Most businesses with card payment terminals allow MasterCard transactions.

- American Express (Amex): American Express is present in Malaysia, but some smaller businesses or less frequented areas may have limited acceptance.

- JCB (Japan Credit Bureau): In some places, you may encounter acceptance of JCB cards, especially in areas with higher tourist traffic.

- Diners Club: Diners Club cards are less common, but some luxury hotels and restaurants may accept this card.

Before traveling, it’s always good to check with your bank to ensure your card is activated for use abroad. Additionally, it’s advisable to carry some cash for situations where credit cards may not be accepted, especially in smaller shops or traditional markets.

Can You Use ATMs at the Airports in Malaysia?

Yes, you can use ATMs at airports in Malaysia. Most international airports in Malaysia are equipped with ATMs that allow cash withdrawals in the local currency (Malaysian Ringgit – MYR) or, in some cases, other currencies such as the US dollar or euro.

ATMs are typically located in central areas of the airport and are easily accessible to travelers. These ATMs may be operated by local banks or international banking institutions such as HSBC, Citibank, or Standard Chartered.

When using an ATM at the airport, it’s always good to be aware of certain things:

-

- Fees: ATMs may charge fees for cash withdrawals. These fees can be set by either the local bank or your home bank.

- Exchange Rates: Some ATMs may offer a conversion rate for withdrawals in the local currency or your home currency. Choose the local currency (MYR) to avoid unfavorable exchange rates.

- Withdrawal Limit: ATMs may have a daily limit for cash withdrawals. Check your limit, and if you need a higher amount, inquire with your home bank.

- Security: As always, be cautious when entering your PIN and securing your payment card. Ensure no one is observing your transactions.

Using an ATM at the airport in Malaysia is usually a convenient way to obtain local currency upon arrival. However, be mindful of the mentioned fees and ensure you have enough cash for potential expenses in case some establishments do not accept credit cards.

Can You Exchange Money at Airports in Malaysia?

Yes, it is possible to exchange money at airports in Malaysia. Most international airports in Malaysia provide currency exchange services at several locations to facilitate travelers in obtaining the local currency, Malaysian Ringgit (MYR). These places include currency exchange booths, ATMs, and sometimes bank branches.

Here are some considerations regarding money exchange at airports in Malaysia:

-

- Airport Currency Exchanges: Malaysian airports typically host currency exchange booths where you can exchange money. These booths are usually located in the arrival and departure halls.

- ATMs: ATMs at Malaysian airports allow cash withdrawals in the local currency. It’s advisable to check for the availability of ATMs at the airport.

- Fees and Rates: When exchanging money at the airport, be cautious about possible exchange rates and fees. Some currency exchanges or banks may charge higher fees or offer less favorable rates.

- Opening Hours: The opening hours of currency exchanges at airports may be limited. If you plan to exchange money late at night or early in the morning, some places may be closed.

- Card Payments: In some cases, you may also use credit cards for purchases or services at Malaysian airports.

Before your trip, it’s advisable to consider how much cash you’ll need. Also, keep in mind that exchanging money at the airport may be particularly convenient for obtaining necessary cash for initial expenses.

ATM Withdrawal Fees and Limits in Malaysia:

ATM withdrawal fees in Malaysia may depend on several factors, including the type of ATMs and the type of credit or debit card you are using, as well as your home bank’s policies. Withdrawal limits may also be influenced by the policies of both local and home banks. Here is some general information, but it’s advisable to consult directly with your bank for specific and up-to-date details:

ATM Withdrawal Fees in Malaysia:

-

- Local Bank Fees: Local ATMs may charge fees for cash withdrawals. These fees can vary by bank and card type. The fees are usually displayed on the ATM screen before the transaction is completed.

- Card Issuer Fees: Your home bank (card issuer) may also charge fees for international cash withdrawals. These fees depend on the terms of your agreement with the bank.

- Foreign Currency Withdrawal: Some ATMs offer the option of withdrawing cash in foreign currencies (e.g., US dollars or euros), which may be convenient but often comes with conversion fees.

Withdrawal Limits in Malaysia:

-

- Daily Limits: Banks may set daily limits for ATM withdrawals. These limits can be specific to each bank and may be adjusted based on the type of account or card.

- Card Issuer Limits: Your home bank may also have its own limits for international cash withdrawals. These limits depend on the policies and types of accounts in your home bank.

Example Values:

-

- Local Fees: ATM withdrawal fees, for example, may range from 1-5 MYR (Malaysian Ringgit) per transaction.

- Card Issuer Fees: Card issuer fees, for example, may range from 2-5 USD (US dollars) or similar amounts in the home currency.

- Daily Limits: Daily limits for ATM withdrawals, for example, may range from 1,000 – 5,000 MYR or more.

What to Watch Out for When Paying in Malaysia?

When paying in Malaysia, it’s advisable to be cautious and keep in mind several important factors to minimize risks and ensure secure transactions. Here are some tips and warnings:

-

- Fraudulent Practices: Just like in many other destinations, be cautious of fraud. When making payments, ensure that you are in a safe and trustworthy location.

- Account Checking: Regularly monitor your bank statements and transactions on credit cards. In case of discrepancies, contact your bank as soon as possible.

- PIN Security: When entering your PIN at ATMs or making payments in stores, cover the keypad with your hand to prevent eavesdropping or observation.

- Secure Card Storage: Keep your payment cards in a secure place, such as a wallet with RFID blocking, to minimize the risk of scanning.

- Avoiding Cash: Avoid using large amounts of cash unless absolutely necessary. It’s safer to use payment cards or mobile payments.

- Checking Exchange Rates: If you exchange money, be aware of exchange rates and potential fees. It’s advisable to avoid exchange services with unfavorable terms.

- Secure WiFi Connection: When conducting online transactions or using mobile payment apps, ensure that you are using a secure WiFi connection.

- Card Retention at Restaurants: If the staff brings a card terminal for payment, stay with your card. Some establishments may misuse the situation to retain the card.

- Cash Withdrawal from ATMs: When withdrawing cash from an ATM, verify the fees and choose the option to withdraw in the local currency.

- Awareness of Local Customs: Be mindful of local customs and practices, especially regarding payment and tipping.

❓ FAQ + TIPS – Money and Currency in Malaysia:

1. What is the currency in Malaysia, and what are the current trends in its value?

-

- In Malaysia, the official currency is the Malaysian Ringgit (MYR). Current trends in the value of the ringgit are influenced by monetary policy, macroeconomic conditions, and the global situation. The Malaysian central bank, Bank Negara Malaysia, regularly monitors and adjusts the monetary policy.

2. What is the availability of ATMs in Malaysia, and how is access to cash?

-

- Malaysia has an extensive network of ATMs, commonly available in both urban and rural areas. Most ATMs accept international cards, facilitating travel and providing convenient access to cash.

3. What are the preferred payment methods in Malaysia?

-

- In Malaysia, common payment methods include cards and cash. International credit and debit cards like Visa and MasterCard are generally well-accepted in stores, restaurants, and most tourist spots.

4. What are the usual rules for currency exchange in Malaysia?

-

- Currency exchange is often done in banks and authorized exchange offices. Most banks offer currency exchange services at fair rates. It’s important to monitor current exchange rates and avoid unauthorized exchange offices.

5. How are purchases conducted in Malaysia, and what is the tax policy?

-

- Shopping in Malaysia is diverse, including markets, shopping malls, and boutiques. Tourists are usually exempt from the Goods and Services Tax (GST) on certain items, but it’s recommended to stay informed about current tax policies.

6. What is the availability of online payments and digital wallets in Malaysia?

-

- Digital wallets and online payments are becoming increasingly popular in Malaysia. Services like GrabPay and Boost allow cashless payments and are often accepted in various stores and restaurants.

7. What are the fees for cash withdrawals from ATMs in Malaysia?

-

- Fees for cash withdrawals from ATMs may depend on the card type and bank. Usually, these fees are reasonable, but it’s advisable to inquire about potential fees and limitations associated with ATM withdrawals.

8. Where is the best place to exchange money for ringgits?

-

- Exchanging money for ringgits is possible at banks, exchange offices, and airports. Banks typically offer fair exchange rates, but exchange offices may be more convenient. Exchange rates at airports, however, may not be as advantageous.

9. Are there any specific rules in Malaysia regarding card payment in restaurants?

-

- In restaurants in Malaysia, credit cards are commonly accepted, but in smaller establishments, cash may be preferred. It’s advisable to always have some cash as a backup plan.

10. Are there any places in Malaysia where card payments may encounter limitations?

-

- In touristy areas, card payments are usually smooth. However, in rural areas and markets, card acceptance may be more limited, so it’s recommended to have cash on hand.

11. Do the rules for card payment in Malaysia change due to security measures?

-

- In Malaysia, standard security measures for card payments are implemented, including identity verification and the use of PIN codes. Security measures are similar to those in most countries.

12. Is tipping customary in Malaysia, and what is the practice in restaurants?

-

- In Malaysia, tipping is not mandatory, but rounding up the amount to whole ringgits is common. In some restaurants, a service charge may be automatically included, but it’s good to inquire whether separate tipping is necessary.

13. Are there any rules in Malaysia for cash withdrawals from ATMs at night?

-

- Most ATMs in Malaysia are available 24/7, but it’s always good to observe safety precautions when withdrawing cash at night, especially in less illuminated areas.

14. What is the general level of security regarding cash payments in Malaysia?

-

- Malaysia is generally a safe destination, but it’s recommended to adhere to basic precautions, such as monitoring financial transactions, using official ATMs, and avoiding unofficial exchange offices to minimize the risk of fraud and theft.

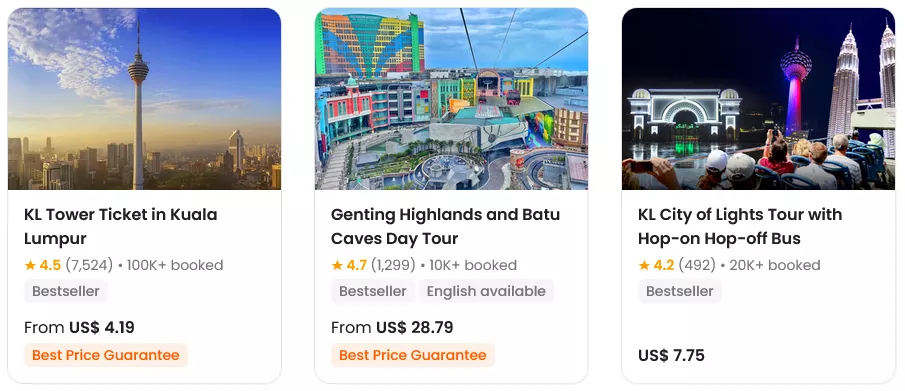

BOOK a TOUR / ACTIVITY in Malaysia ➜

Prices in Laos|Prices in Cambodia|Souvenirs from Thailand|Souvenirs from Laos|Interesting Facts of Thailand|Interesting Facts about Cambodia